📊 1. Quick Performance Recap

The last two weeks delivered very different outcomes:

Week 1: +6.70R

Week 2: –3.08R

Preliminary Month 1 stats: 61.1% win rate; total result: +3.61R (see appendix on how we measure trading success)

We stay focused on process, not individual weeks.

The playbook and systems remain unchanged — volatility and variance are part of trading.

📌 Market Outlook — Where Crypto Stands Now

The crypto market is currently in a transitional phase.

BTC is consolidating and remains under pressure, with the potential for a deeper liquidity sweep before clearer direction returns. This type of corrective structure is normal after strong moves and often sets the stage for healthier price action later on.

Meanwhile, altcoins are beginning to show early signs of relative strength. Capital is rotating, and several names are starting to form constructive setups — a dynamic we typically see before broader market recoveries.

Looking out over the next 3–6 months, the bigger picture remains encouraging.

Once BTC completes its consolidation and reclaims key levels, the market has meaningful recovery potential, especially across quality altcoins.

Short-term caution.

Mid-term opportunity.

📉 2. BTC Market Structure

BTC is currently rotating inside a well-defined range after last week’s bounce.

Price rejected the 92–93k resistance zone and is now hovering around mid-range.

Key takeaways:

Major supports: 83.6k → 80k → 76.7k

Resistance: 93k

Open Interest shows shorts entering, funding and premium remain neutral/negative

HTF structure forming a bear flag

Mid-Term Outlook

BTC may need a deeper liquidity sweep into the 80k zone, which aligns with HTF demand.

Macro confirmation requires a weekly close back above the EMA50.

The Bitcoin Satoshimeter also places us inside the accumulation band — not a bottom signal, but historically a phase of cycle consolidation.

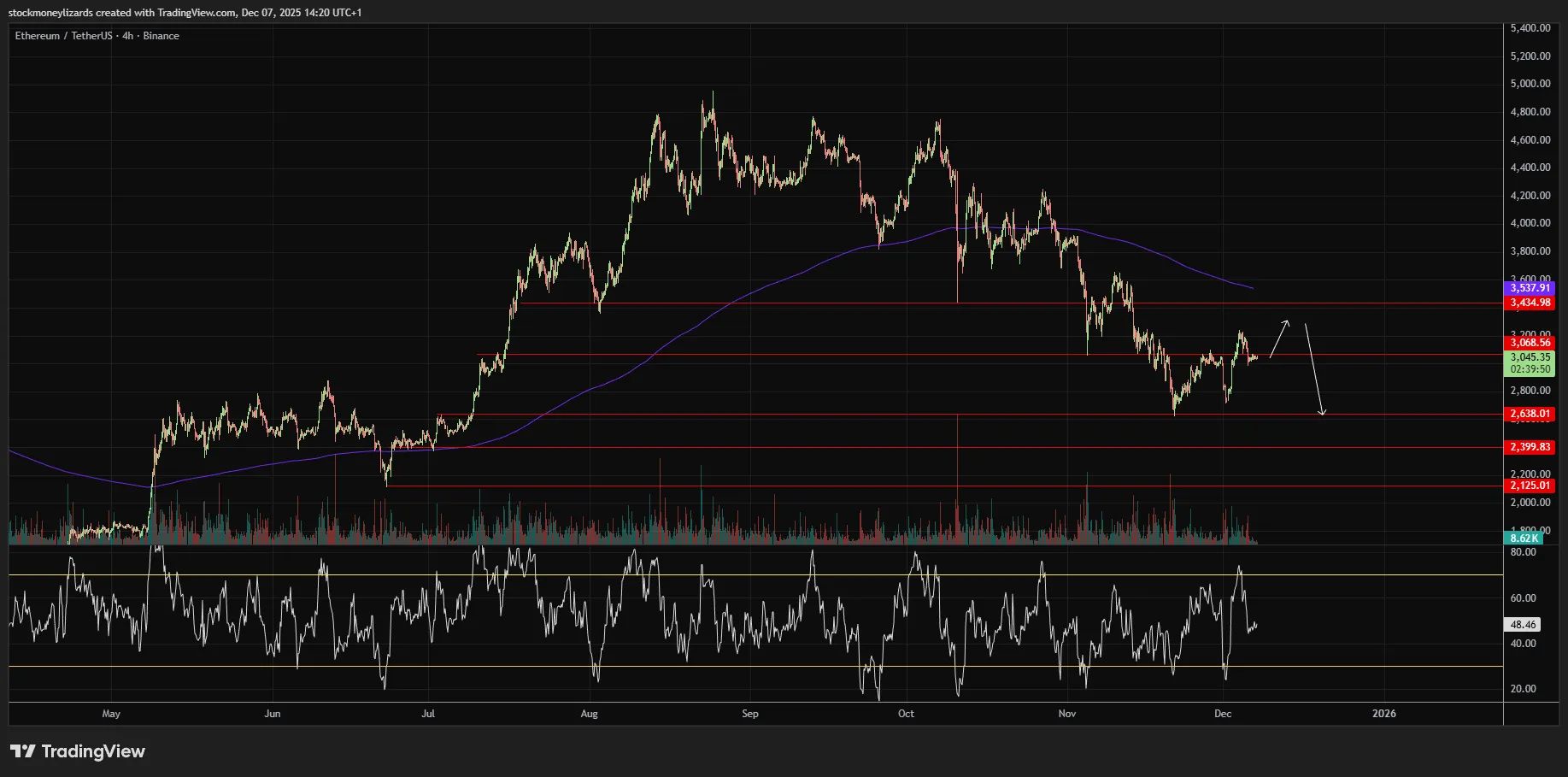

📉 3. ETH Levels (Quick View)

ETH continues to mirror BTC:

Capped by 3,311–3,435 resistance

Support sitting at 3,047 → 2,638 → 2,399

Weak momentum until BTC shows clearer direction

A break above 3,435 would improve structure, but downside rotation remains possible.

🔥 4. Altcoin Watchlist (Lite Version)

BAT — Momentum Follow-Up

BAT hit the $0.30 last week, aligning with our premium analysis. Now BAT is forming a double top with bearish divergence - potential short opportunity.

Additional Watchlist

SUI: Breakout against BTC and USDT

ZEC: Post-pump correction — watching volatility structure

BNB: Relative strength vs BTC remains notable

Full setups, entries, and system bias remain exclusive to Premium.

🧭 5. Key Themes for the Week

BTC in a mid-range chop → patience needed

Potential liquidity sweep lower before any macro shift

Altcoins showing selective strength

Macro still supportive of accumulation

Systems stay unchanged: SML1 takes lead, SML2 selective, SML3 reactive

🔒 Want the Full Playbook?

The free digest is the high-level outlook.

Inside The Lab Premium you get:

✓ Full Weekly Playbook

✓ Detailed setups (entries, SL, TP logic)

✓ System bias (SML1 / SML2 / SML3)

✓ Trader breakdown

✓ BTC, ETH, and altcoin charts

✓ Weekly stats & R-based transparency

✓ Real-time trades via The Lab Bot

Join here → The Lab premium (30 / 180 days plan) via Lemonsqueezy

or join via our free Discord.

⚠️ Disclaimer

This newsletter is for informational and educational purposes only. We have positions in the assets discussed here. It does not constitute financial advice, trading advice, or investment recommendations. Any market commentary, analysis, charts, or outlooks reflect our personal opinions and are not guarantees of future performance.

Cryptocurrency trading involves significant risk and may not be suitable for all investors. Always conduct your own research and consider your risk tolerance before making trading decisions. The Lab, its contributors, and its systems (SML1/SML2/SML3) do not take responsibility for losses incurred from trades based on this content.

🧮 How We Measure Performance at The Lab

All performance is tracked using R-based results, a professional risk-adjusted metric used by systematic traders.

1R = 1 unit of risk, defined by the distance between entry and stop-loss.

A trade that returns +2R means it earned 2× the initial risk.

A trade that returns –1R means the full risk unit was lost.

Why this matters:

It normalizes all trades, regardless of position size or asset.

It prevents emotional interpretation of wins/losses.

It shows true system performance over time.

It allows us to compare trades and weeks on the same scale.

Our weekly and monthly stats reflect the net sum of R across all closed trades.

This ensures the results remain objective, consistent, and comparable across all market conditions.